Getting the best banking deal for small businesses

MEDIA RELEASE

20 September 2007

Getting

the best banking deal for small

businesses

Four out of five small businesses could be paying more than they need to in bank charges, say Waikato Management School finance researchers. But they say making the right choice isn’t easy as banks use different fee structures, and costs vary depending on things like numbers of bouncing cheques or international transactions.

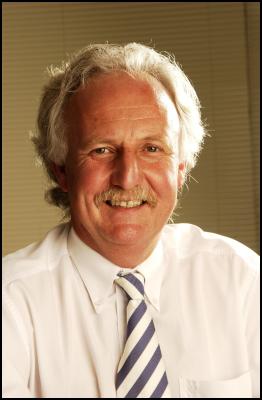

In a paper to be presented at the Small Enterprise Conference in Manukau next week, Associate Professor Stuart Locke and two graduate students Zachariah Boulanouar and Weijun Qi compared costs and services for the five main banks, and mapped them onto five typical small business transaction ‘packages’.

“Our findings show small businesses could save more than $1,000 a year if they pick the right bank,” says Dr Locke.

Using their simulation model, the researchers found a typical small dairy would pay $287.52 a month if it banked with National, as compared with $378.85 a month with Westpac – a difference of $91.34.

Dr Locke said the results depended on the type of transactions and volume, and a radically different transaction mix could reverse the results.

The model showed ASB was the best bet if two or more cheques bounce each year, while BNZ was the top choice for businesses with eight or more international transactions a month. Firms which process a lot of cheques would do best to bank with ANZ.

“Unusual or one-off transactions – such as unauthorised overdrafts or bouncing cheques -- can really throw the results,” says Dr Locke. “Presumably most businesses don’t get this sort of thing wrong month after month; if they do, they’re probably not going to stay in business too long so the cost of banking becomes irrelevant.

The researchers say there’s very little information publicly available on getting the best banking deals. “One study estimated it would take a small business owner up to three days to compare banks,” says Dr Locke. “Our simulation model provides a much quicker way to analyse banking fees. It could be a useful tool for small business advisers and accountants, who can be held accountable for any advice they give.”

The Small Enterprise Conference 2007 – Building Sustainable Growth in SMEs will be held at the TelstraClear Pacific Events Centre, Manukau City, on 23-26 September 2007

www.smallenterpriseconference2007.com

ENDS

GNS Science: Bioshields Could Help Slow Tsunami Flow

GNS Science: Bioshields Could Help Slow Tsunami Flow Transport and Infrastructure Committee: Inquiry Into Ports And The Maritime Sector Opened

Transport and Infrastructure Committee: Inquiry Into Ports And The Maritime Sector Opened Netsafe: Netsafe And Chorus Power Up Online Safety For Older Adults

Netsafe: Netsafe And Chorus Power Up Online Safety For Older Adults RBNZ: 10 Cent Coin With King Charles III Image Now In Production

RBNZ: 10 Cent Coin With King Charles III Image Now In Production NZALPA: Safety Improves From AKL Incident Learnings

NZALPA: Safety Improves From AKL Incident Learnings NIWA: Antarctic Footprint Clean-up Challenges - How A Remote Antarctic Base Clean-up Protected One Of Earth’s Clearest Lakes

NIWA: Antarctic Footprint Clean-up Challenges - How A Remote Antarctic Base Clean-up Protected One Of Earth’s Clearest Lakes