House Prices Fall For 2nd Consecutive Mnth In July

House prices fall for the second consecutive month in July

According to today's early release of the REINZ July property price report, the national median house price dropped 0.7% to NZ$345,000. July's house price decline was the second consecutive monthly fall - down from NZ$347,500 in June and the record NZ$350,000 recorded in May. Furthermore, in what was a broadly weak report, the Auckland market (New Zealand's largest) prevented the national median price from falling further as strong performances by the North Shore, Waitakere and Auckland City property markets kept the median price unchanged at NZ$445,000.

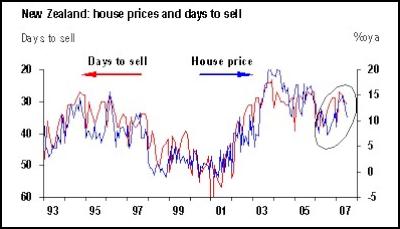

The decline in the median national house price was intertwined with a dramatic drop off in trading activity (sales dropped 14.2%oya in July to 6,660 - the lowest level since July 2001), and an increase in the number of days to sell (up to 31 days from 30 in June and 27 in March). Days to sell gives a good read on the direction of property prices - see chart below - and is pointing to further downside.

The dramatic fall in trading activity can be partially explained by poor weather conditions over the past two months, but it is more likely to have been a change in sentiment that drove the exodus from the market. Investors and new home buyers are coming to terms with much higher interest rates, threats from both the RBNZ and Government of changes to tax arrangements around investment housing (ring-fencing property losses - i.e. removing the ability to offset investment property losses against personal income), and a burgeoning housing affordability crisis. According to Massey University's latest housing affordability report, the rise in house prices and interest servicing costs is fast outpacing growth in income.

In a speech earlier today to the Parliament's commerce committee, Bernard Hodgetts, senior advisor at the RBNZ, stated that New Zealand’s housing market is indeed 'cooling down' amid signs the economy's pace may be slowing. Hodgetts stated that "House prices are likely to level off and that's based on our belief that the economy is moving into a cooling kind of position." In order for the RBNZ to remain on hold, the housing market must continue to show signs of rolling over.

ENDS

The Reserve Bank of New Zealand: 2024 General Insurance Stress Test Results Published Today

The Reserve Bank of New Zealand: 2024 General Insurance Stress Test Results Published Today  Worldline: School Holidays And Long Weekends Change Regional Spending Patterns In April

Worldline: School Holidays And Long Weekends Change Regional Spending Patterns In April Stats NZ: Livestock Numbers Fall Over The Last 10 Years While Area Planted In Fruit Increases

Stats NZ: Livestock Numbers Fall Over The Last 10 Years While Area Planted In Fruit Increases Moths and Butterflies NZ Trust: Tagged Monarchs Found

Moths and Butterflies NZ Trust: Tagged Monarchs Found Master Plumbers Gasfitters and Drainlayers NZ: 2025 New Zealand Plumbing Conference Awards - Full List Of Winners

Master Plumbers Gasfitters and Drainlayers NZ: 2025 New Zealand Plumbing Conference Awards - Full List Of Winners Insurance Council of New Zealand: Insurers Support Kiwis As Severe Weather Eases

Insurance Council of New Zealand: Insurers Support Kiwis As Severe Weather Eases