Discount rate for Fonterra’s annualised shares

Dairy Industry Restructuring Act: Commission sets final discount rate for Fonterra’s annualised share value

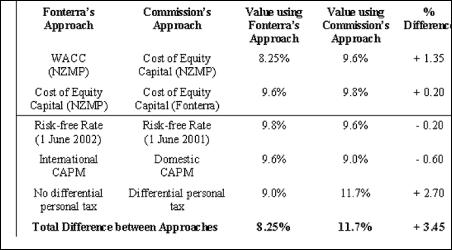

The Commerce Commission has confirmed its preliminary findings into setting the discount rate for calculating Fonterra Co-operative Group Limited’s annualised share value for the 2001-2002 season. In releasing its final determination today, the Commission has set the discount rate at 11.7 percent, which is the same rate published in the Commission’s draft determination in January. This compares with the discount rate proposed by Fonterra of 8.25 percent.

The discount rate is used in calculating the default milk price paid by independent processors. Under the Dairy Industry Restructuring (Raw Milk) Regulations 2001, the Commission is required to set a discount rate for calculating the annualised share value in circumstances where Fonterra does not use a cost of capital rate in calculating the price of a co-operative share.

Commission Chair John Belgrave said five methodological differences explain almost all of the difference between the Commission and Fonterra’s estimates of the cost of capital in determining the discount price.

“The key differences were the fact that the Commission adopted a cost of equity capital rather than a weighted average cost of capital as proposed by Fonterra, and also that the Commission adopted different personal tax assumptions compared to Fonterra,” said Mr Belgrave.

“Now that the Commission has set the discount rate, it is up to Fonterra to assess whether any adjustments are required to the default milk price charged to independent processors during the 2001/02 season.”

The Commission’s

final determination is available on www.comcom.govt.nz

(select Dairy Industry Restructuring Act, Commission

Decisions).

Background Regulation 9(2) of the Raw Milk Regulations requires that the Commission set a discount rate for calculating annualised share value in circumstances where Fonterra does not use a cost of capital rate in calculating the price of a co-operative share.

Fonterra advised the Commission that it did not use a cost of capital rate in calculating the price of a co-operative share for the 2001-2002 season.

The share price for the 2001-2002 season was $3.00 per share and was agreed as part of the Merger Proposal for the merger of New Zealand Co-operative Dairy Company Limited and Kiwi Co-operative Dairies Limited.

The discount rate for calculating the annualised share

value for the 2001-2002 season is required by Fonterra in

order that it may calculate the wholesale milk price and the

default milk price for the 2001-2002 season.

Hugh Grant: Navigating Digital Adoption In New Zealand - Embracing Change For A Bright Future

Hugh Grant: Navigating Digital Adoption In New Zealand - Embracing Change For A Bright Future Dawn Aerospace: Historic Flight - Breaks Sound Barrier And Global Records

Dawn Aerospace: Historic Flight - Breaks Sound Barrier And Global Records SEEK: SEEK NZ Employment Report - October

SEEK: SEEK NZ Employment Report - October University of Auckland: Protecting Young Minds With AI

University of Auckland: Protecting Young Minds With AI Greenpeace: Greenpeace Calls On Fonterra Investors To Consider Big Picture With Giant Puzzle

Greenpeace: Greenpeace Calls On Fonterra Investors To Consider Big Picture With Giant Puzzle Hugh Grant: How New Tech Helps Kids Love Soccer More

Hugh Grant: How New Tech Helps Kids Love Soccer More