Nationwide annual value growth drops to below 10%

PLEASE NOTE NEW EMBARGO THIS INFORMATION IS STRICTLY

EMBARGOED UNTIL 5.00AM JUNE 1,

2017

Nationwide annual value growth drops to below 10% which is the slowest rate in two years

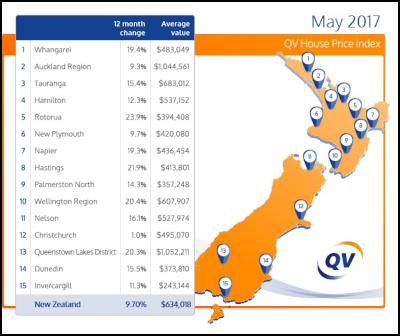

The latest monthly QV House Price Index shows nationwide residential property values for May increased 9.7% over the past year which is the slowest annual rate in two years. Values rose by 0.4% over the past three months and the nationwide average value is now $634,018 which is 53.0% above the previous market peak of late 2007. When adjusted for inflation the nationwide annual increase drops slightly to 7.4% and values are now 27.8% above the 2007 peak.

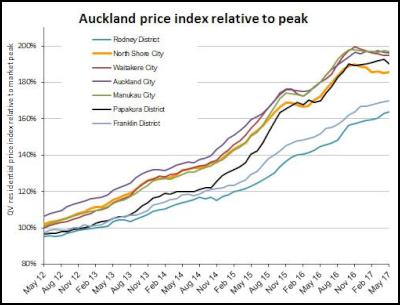

Residential property values across the Auckland Region increased 9.3% year on year which is the slowest annual rate of growth seen since November 2014. Quarterly value growth remains flat, rising just 0.1% over the past three months. The average value for the Auckland Region is now $1,044,561 and values are now on average 91.1% higher than the previous peak of 2007. When adjusted for inflation values rose 7.0% over the past year and are 44.0% above the 2007 peak.

The full set of QV House Price Index statistics for all New Zealand for April can be downloaded by clicking this link: QV House Price Index (HPI) for May 2017

QV National Spokesperson Andrea

Rush said, “Nationwide value growth continues to ease back

due to lower demand in the housing market caused by the

latest round of LVR restrictions and tougher lending

criteria from the banks as we head into the winter

period.”

“Sales volumes are lower than they were this time last year particularly in Auckland and its possible market activity may now remain more subdued until after the election.”

“Value growth continues to be stronger in Wellington and Dunedin than in the other main centres but is also starting to ease back a little.”

“With Auckland and Hamilton only seeing very slight value growth over the past three months and values dropping slightly in Christchurch these markets are relatively flat by comparison.”

“Values in Tauranga are showing stronger quarterly growth than last month but across the board it appears much of the frenzy has come out of the housing market there and have returned to more normal levels of activity and demand.”

“Regional North Island centres continue to see some of the strongest growth including Rotorua, the Hawkes Bay, Whangarei, Northland with the Kaipara District north of Auckland accelerating by 25.1% year on year and 9.2% over the past three months.”

“Most regional centres are now seeing the strongest value growth since prior to the previous peak of 2007 including Opotiki, Gisborne and the South Waikato District. The only North Island areas to see values decrease over the past three months were some parts of Auckland; Hamilton’s North Eastern suburbs and New Plymouth.”

“In the South Island, there’s been positive value growth across most areas and values have begun accelerating in the Tasman District while strong growth continues in the MacKenzie and Central Otago Districts. The only areas to see values decrease over the past three months were the Buller District on the West Coast, and parts of Christchurch; the Waimate District and the Clutha District. “

Auckland

Values across the Auckland

Region are continuing to plateau with values increasing by

just 0.1% over the past three months. However, values in

Rodney – North continue to show steady growth, rising more

than any other area, up by 15.5% year on year and 3.9% over

the past three months. While values dropped back 1.1% in

Auckland City’s Eastern suburbs including St John,

Meadowbank, Glenn Innes, Point England, Orakei, Kohimarama,

Mission Bay, Ellerslie, Greenlane and Stonefields.

QV Auckland homevalue Manager, James Steele said, “We are seeing a return to more “normal” market conditions currently in the Auckland market.”

“There are more properties listed for sale on the market, there is also demand and properties are selling, but some of the heat has come out of the market, and buyers are being more picky about what they buy.”

“Properties with undesirable features or outstanding maintenance are sitting around on the market for a longer.”

“Record prices are still being achieved for well-positioned and well-maintained properties, but were the property doesn’t meet those criteria, sellers may have to settle for a lower price than they may have achieved mid-last year.”

“We are also seeing vendors who are willing to withdraw their properties from the market if they do not achieve the price offer they are wanting”.

“Entry level homes in South Auckland suburbs such as Mangere, Papakura and Manurewa where you can still find a property for under $650,000 are being sold mostly to first home buyers with investors no longer very active in this part of the market.”

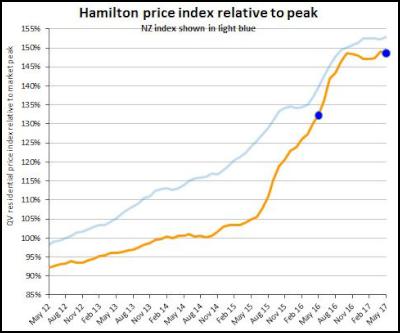

Hamilton

Hamilton City home values rose slightly by 0.9%

over the past three months. Values were 12.3% higher than in

May 2016 and they are now 48.6% higher than the previous

peak of 2007. The average value in the Hamilton is now

$537,152.

QV homevalue Hamilton valuer, Stephen Hare said, “The Hamilton city market is experiencing a bit of a winter slow-down and sales volumes are down on the same time last year.”

“However, listings levels are also quite low and there is more demand than supply for entry level properties in the under $400,000 price bracket.”

“Properties that are well-located and presented are selling well unless vendor price expectations are too high. Properties with any issues are taking longer to sell than they were when the market was more frenzied.”

“Auctions are no longer the preferred way to sell in the current market as many have been passing in and instead we are seeing more properties being marketed with a listing price or by negotiation.”

“Listings levels are low in surrounding towns such as Cambridge and Te Awamutu and demand is strong for well-located properties in Cambridge. Te Awamutu is also popular and is still considered an affordable alternative to Hamilton and Cambridge being only 30 minutes commuting distance to Hamilton.”

“There is more housing stock listed for sale in the under $400,000 price range in Te Awamutu than in Cambridge and Hamilton where properties in this price bracket are increasingly hard to find.”

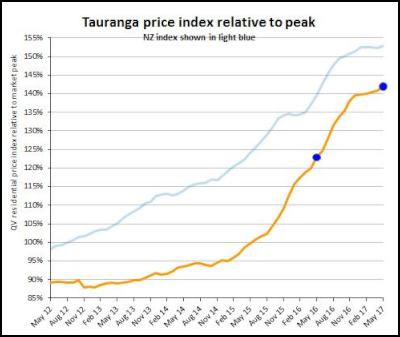

Tauranga

Tauranga values

rose at a faster quarterly rate in May than during April up

by 1.3% over the past three months and 15.4 % year on year.

Values there are now 41.9% higher than the previous peak of

2007. The average value in the city is $683,012. Meanwhile,

Western Bay of Plenty values have increased 14.6% year on

year and 3.5% over the past three months. The average value

in the district has now topped $600,000 to reach

$602,059.

QV homevalue Tauranga, Registered Valuer, David Hume said, “Activity in the investor market in Tauranga is now at more normalised levels.”

“Demand for Mount Maunganui based properties remains strong as does demand for other high-end properties in the city and region.”

“There is a shortage of large family homes on full sites and a number of new subdivisions around Tauranga are continuing to be developed, with a trend of smaller lot sizes with sections under 400 square metres now becoming more common.”

“The Western Bay of Plenty market is showing steady growth although not at the frantic levels seen throughout 2016.”

Wellington

The QV House Price Index shows values across

the entire Wellington region rose 20.4% year on year and

3.1% over the past three months and values are now 33.4%

higher than in the previous peak of 2007. The average value

across the wider region is now $607,907. The Kapiti Coast

District saw the highest value growth over the past three

months with values rising 4.5%; followed by Wellington

City’s Western suburbs where values rose 4.4% over the

same period.

QV homevalue Registered Valuer, David Cornford said, “The Wellington market remains buoyant however there are signs that it is losing some steam as winter approaches.”

“There is less market activity, a decrease in the number of sales and less buyer demand compared to the previous 12 months.”

“This has led to the rate of value growth plateauing or even slightly decreasing and some properties which are also taking slightly longer to sell.”

“Good prices are still being achieved however the market is less frantic and properties with undesirable features are now sitting on the market for longer.”

“First home buyers are still active, especially in the Hutt Valley and Porirua and properties under $550,000 are generally selling well.”

“A relatively small number of properties have been taken off the market after the vendor hasn’t achieved the price they were hoping for.”

“Slightly more properties are selling after second attempt campaigns where auctions or tenders have failed to meet the sellers’ expectations. “

“Investors are still in the market however quite a number of them are still struggling to secure finance since the introduction of LVR restrictions last year.”

“Value growth has slowed to 3.1% per quarter; this is less than 2016 where some quarter’s recorded growth of 6.0 to 7.0%.”

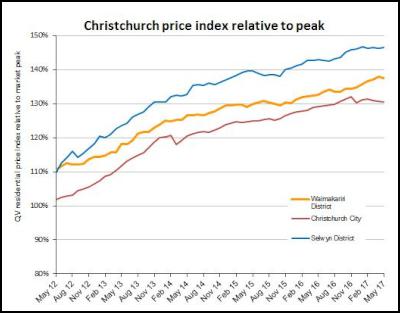

Christchurch

Christchurch City values rose just 1.0% in the

year since May 2016 and decreased by 0.7% over the past

three months. They are now 30.5% higher than the previous

peak of 2007.

QV homevalue Christchurch, Registered Valuer Daryl Taggart said, “Growth is the lowest seen in Christchurch in a number of years and now that we are heading into winter we are unlikely to see this pick up in the near future.”

“The market has been creeping upwards for a long time after the initial surge in values. Recent stats show that the heat has come off the market and value growth is stalling.”

“You wouldn’t expect to see a reduction in value just yet however there is certainly not a lot of capital gain to be made in the current market.”

“Couple this with a continuing reduction in rental returns over the last 18 months and investors will be looking at their bottom line.”

“As the market evens out homeowners will need to look for alternate ways to add value.”

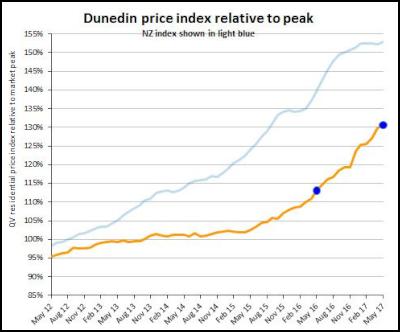

Dunedin

Dunedin home

values are continuing on an upward trend, they rose 15.5% in

the year since May 2016 and 3.9% over the past three months

and values are now 30.6% above the previous peak of 2007

which is on par with the percentage Christchurch values are

above 2007 levels. The average value in the city is now

$373,810.

QV homevalue Dunedin Valuer, Aidan Young said, “Dunedin-coastal values have seen the strongest growth rising 6.6% over the past three months and 20.1% year on year.”

“But we continue to see steady demand across all parts of the Dunedin market.”

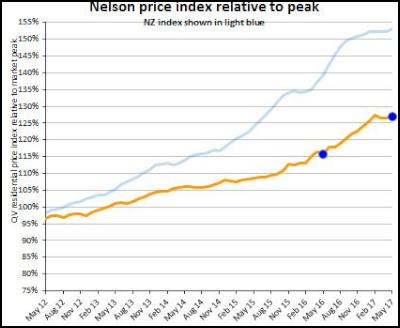

Nelson

Nelson home

values rose 16.1% year on year and 2.7% over the past three

months. The average value in the city is now $527,974.

Meanwhile values have jumped 6.7% in the Tasman District

over the past three months and are 18.8% higher than in May

last year. The average value in the district is now higher

than Nelson and is $534,908.

QV homevalue Nelson, Registered Valuer Craig Russell said, “Land continues to be the main driver of values in the region with a continuation of strong section prices being achieved.”

“Buyer interest is still strong but there is a more cautious approach being taken by prospective purchasers.”

“Properties under $450,000 are continuing to have strong interest and are selling readily if well-presented and listing numbers have remained steady over recent months.”

“Executive quality homes with coastal views between Richmond and Ruby Bay in the $1 million plus price bracket have also been selling well of late.”

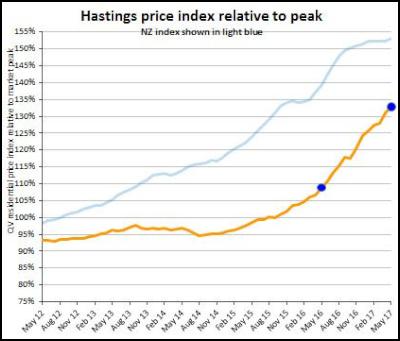

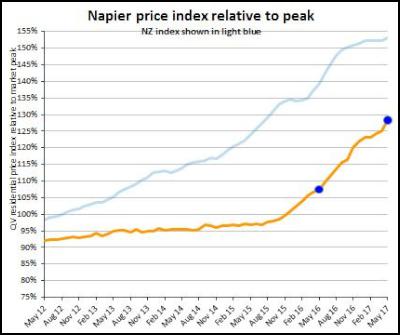

Hawkes

Bay

Values continue to rise across the Hawkes

Bay region and Napier values rising 19.3% year on year and

4.1% over the past three months. The average value in the

city is now $436,454 and values are now 28.3% above the

previous peak of 2007. The Hastings market also continues to

see strong value growth rising 21.9% year on year and 4.2%

over the past three months and the market is now 32.8%

higher than 2007. The average value there is now

$413,801.

QV homevalue Hawkes Bay, Registered Valuer Michelle Drinkrow said, “Overall we are seeing plenty of activity in the Hawkes Bay market and while there is still good interest from buyers they are less frenzied and taking their time a little bit more.”

“We are continuing to see a lack of listings and there’s also a lack of vacant land available. We understand interest in newly completed residential subdivisions is high and in turn the price of vacant land has been steadily increasing.”

“We are continuing to see a lot of out-of-town buyers in the market particularly in the $1 million plus price bracket.”

“At the lower end of the market investors and first home buyers are still fairly active and the LVR restrictions do not seem to have impacted investor activity that much here.”

“There is a lack of rental property available and with demand higher than supply we are seeing rents rising across the region.”

Provincial

centres

Values increased over the past year in

all provincial areas of the North Island and there has been

particularly strong growth in areas where values have been

flat for many years including East Coast areas such as

Opotiki where values rose 22.5% year on year and 12.9% over

the past three months; also in Gisborne where values rose

19.1% in the year since May 2016 and 3.2% over the past

three months and also in South Waikato District where they

jumped 32.0% year on year and 4.5% over the past three

months.

In provincial areas of the South Island most areas saw values rise over the past year with the MacKenzie District rising 35.6% in the year since May 2017 and 9.6% over the past three months; Central Otago was also up 20.3% year on year and 6.4% over the past three months and values in Westland began to rise again by 11.4% year on year and 5.7% over the past three months after.

Gordon Campbell: On The Left’s Electability Crisis, And The Abundance Ecotopia

Gordon Campbell: On The Left’s Electability Crisis, And The Abundance Ecotopia NZCAST: NZCAST Leads Ongoing Cross-Agency Collaboration To Break Down Barriers For Survivors Of State Abuse

NZCAST: NZCAST Leads Ongoing Cross-Agency Collaboration To Break Down Barriers For Survivors Of State Abuse Regional and Unitary Councils Aotearoa: Regional And Unitary Councils Back A Practical FWFP System

Regional and Unitary Councils Aotearoa: Regional And Unitary Councils Back A Practical FWFP System NZ Government: Stay Safe On Our Roads This Easter

NZ Government: Stay Safe On Our Roads This Easter YWCA: Global Push Back Against Gender Equality A Growing Crisis In Aotearoa

YWCA: Global Push Back Against Gender Equality A Growing Crisis In Aotearoa Te Pāti Māori: Ngarewa-Packer - Fast-Tracking Seabed Mining Ignores Māori Opposition And Environmental Precedent

Te Pāti Māori: Ngarewa-Packer - Fast-Tracking Seabed Mining Ignores Māori Opposition And Environmental Precedent New Zealand Defence Force: Defence And Customs Strengthen Maritime Security With Uncrewed Surface Vessels

New Zealand Defence Force: Defence And Customs Strengthen Maritime Security With Uncrewed Surface Vessels