Regional markets start to show strength in April

Regional markets start to show strength in April

Summary

• 7,234

dwellings sold in April 2015, up 27.6% on April 2014 and

down 17.8% on March 2015

• National median price

of $455,000, up $22,750 on April 2014 and down $20,000 on

March 2015

• A rise of 5.3% in the national

median price in the 12 months to April

2015

• The national median price, excluding

Auckland, up $3,000 compared to April 2014 and March

2015

• A rise of 18% in Auckland’s median

price, from $611,500 to $720,000, between April 2014 and

April 2015

REINZ, the most up to date source of real estate data in New Zealand, announced today that there were 7,234 dwelling sales in April 2015, up 27.6% on April 2014 and down 17.8% compared to March.

The national median price was $455,000 for April, an increase of $22,750 or 5.3% compared to April 2014 and a decrease of $20,000 or 4.2% from March. Excluding the impact of the Auckland region, the national median price was up $3,000 (+0.9%) compared to April 2014 and to March, at $353,000.

Real Estate Institute of New Zealand (REINZ) Chief Executive Colleen Milne says, “Auckland continues to dominate the real estate market in terms of price movements, but we are starting to see some of the smaller regions show improvements in the number of sales being made and price increases. Regions such as Northland, Hawkes Bay and Central Otago Lakes, which represent 7.5% of national sales, are seeing solid gains in both price and sales volumes. Other regions such as Waikato/Bay of Plenty are seeing volume growth, while Otago and Taranaki are seeing more price growth.”

“The strong price movements in Auckland, particularly on the North Shore and in Rodney, continue to be driven by high demand from all types of property buyers and from a lack of sufficient new supply – both new builds and listings of existing properties,” Milne says. “New builds take time to be completed. Meanwhile the very low level of new listings suggests that potential vendors are considering factors other than just price in making the decision whether to sell their properties.”

Sales

Volumes

REINZ data shows there were 7,234

unconditional residential sales in April, a 27.6% increase

on April 2014 and a decrease of 17.8% from March. On a

seasonally adjusted basis the number of sales fell by 0.5%

from March to April, indicating that April sales were about

in line with what would normally be expected for this time

of year.

Sales volumes excluding Auckland were down 12.8% compared to March and up 29.4% compared to April 2014, although on a seasonally adjusted basis sales volumes excluding Auckland were up 1.5% from March, indicating that sales outside of Auckland were more robust than the national total.

Two regions recorded increased sales volume compared to March, with Northland recording the largest increase of 15.4%, followed by Central Otago Lakes with 2.7%. Compared to April 2014, all regions recorded increases in sales volume, with Northland recording the largest of 67.8%, followed by Waikato/Bay of Plenty with 53.2% and Central Otago Lakes with 41.1%.

Prices

The

national median house price fell $20,000 (-4.2%) compared to

March, to $455,000. In comparison with April 2014 the

median price increased by $22,750 (+5.3%), with eight

regions recording rises. Excluding the Auckland region, the

national median price rose $3,000 (or 0.9%) compared to

April 2014 and March, to $353,000. On a seasonally adjusted

basis the national median house price rose 5.1% compared to

April 2014 and fell 2.3% compared with March.

Central Otago Lakes recorded the largest percentage increase in median price compared to April 2014, at 18.2%, followed by Auckland at 17.7% and Hawkes Bay at 13.4%. Compared to March, Hawkes Bay recorded the largest percentage increase in median price, at 10.9%, followed by Northland at 8.2% and Southland at 8.1%.

The REINZ Stratified Housing Price Index, which adjusts for some of the variations in the mix that can affect the median price, has been recalibrated and the new indices backdated to January 2011. All HPI commentary is based on the recalibrated index. The NZ House Price Index is 9.3% higher than in April 2014. The Auckland Index rose 18.9% compared to April 2014, the Christchurch Index fell 0.6% and the Wellington Index fell 2.8%.

Please note that House Price Index data will not be included in future monthly news releases on residential property sales. If you wish to access the REINZ HPI figures going forwards, please contact David Shaw, dshaw@reinz.co.nz, to subscribe.

Auctions

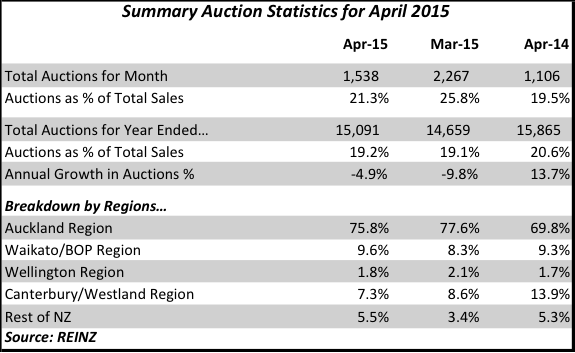

There were

1,538 dwellings sold by auction nationally in April,

representing 21.3% of all sales and an increase of 432 on

the number sold by auction in April 2014. The percentage of

homes sold by auction in the 12 months to April 2015 was

19.2% (15,091 by number), compared to 20.6% (15,865 by

number) for the year ending April 2014.

Transactions in Auckland again dominated the auction market in April, representing 76% of the national total of auction sales. 42% of all dwelling sales in Auckland were by auction in April, compared to 35% in April 2014. Sales by auction in Waikato/Bay Of Plenty accounted for 10% of the national total, Canterbury/Westland accounted for 7% and all other regions combined accounted for the remaining 7% of the national total.

Further Data

Across New Zealand the total value of

residential sales, including sections, was $4.238 billion in

April, compared to $5.381 billion in March and $3.093

billion in April 2014. For the 12 months ended April 2015

the total value of residential sales was $43.775 billion.

The breakdown of the value of properties sold in April 2015

compared to April 2014 is:

| April 2015 | April 2014 | |||

| $1 million plus | 779 | 10.8% | 431 | 7.6% |

| $600,000 to $999,999 | 1,605 | 22.2% | 1,185 | 20.9% |

| $400,000 to $599,999 | 1,860 | 25.7% | 1,557 | 27.5% |

| Under $400,000 | 2,990 | 41.3% | 2,497 | 44.0% |

| All Properties Sold | 7,234 | 100.0% | 5,670 | 100.0% |

ENDS

Gordon Campbell: On Why We Can’t Survive Two More Years Of This

Gordon Campbell: On Why We Can’t Survive Two More Years Of This ACT New Zealand: Liquor Stores Serving Us This Summer Deserve Thanks, And A Stronger Voice

ACT New Zealand: Liquor Stores Serving Us This Summer Deserve Thanks, And A Stronger Voice NZTA: Forecast Strong Winds For Auckland Harbour Bridge Traffic

NZTA: Forecast Strong Winds For Auckland Harbour Bridge Traffic Queenstown Lakes District Council: Top 10 Most Hazardous Items Found In QLDC’s Waste Facilities And Rubbish And Recycling Bins In 2024

Queenstown Lakes District Council: Top 10 Most Hazardous Items Found In QLDC’s Waste Facilities And Rubbish And Recycling Bins In 2024 NZ Government: Drive Safely This Summer

NZ Government: Drive Safely This Summer Northland Inc: Game-Changing Investment For Northland - Resilience Fund Allocates $250,000 To Health Simulation & Training Centre

Northland Inc: Game-Changing Investment For Northland - Resilience Fund Allocates $250,000 To Health Simulation & Training Centre Interchurch Bioethics Council: Church Bioethics Agencies Express Dismay at the Rushed Consultation Period for Submissions on the Gene Technology Bill

Interchurch Bioethics Council: Church Bioethics Agencies Express Dismay at the Rushed Consultation Period for Submissions on the Gene Technology Bill