Home loan affordability worsens ahead of LVR limit

Roost Home Loan Affordability report

For September 2013 – For immediate release

Home loan affordability worsens ahead of LVR limit

Home loan affordability worsened in September after house prices rose again to fresh record highs in the last month before the Reserve Bank's new speed limit on low deposit mortgages kicked in.

A surge of housing market sales activity was evident before the October 1 start for the central bank's 10% limit on the growth of new high Loan to Value Ratio mortgages (over 80%) as a percentage of new mortgage flow. Sales activity was strong, but new mortgage approvals were weak as buyers raced to use their pre-approved mortgages before the October 1 deadline.

Mortgage brokers report new bank mortgage approvals to those with a deposit of less than 20% of the value of a home slowed sharply through the last two months as banks adjusted to the late August announcement by the Reserve Bank of its 'speed limit' to try to slow housing inflation running at between 10% and 20% in Christchurch and Auckland.

Three of the four big banks (ANZ, Westpac and BNZ) have begun offering preferentially low interest rates to borrowers with more than 20% equity and are imposing 'low equity premiums' on borrowers with less than 20% equity. Some are rejecting applications from those wanting to borrow more than 80% and ASB withdrew its pre-approvals for mortgages over 80%.

October is seen as the first key test of how strong the housing market remains and whether the Reserve Bank's measures are starting to have any success.

"Borrowers and banks are adjusting to the new environment, which is creating opportunities for some," said Roost Mortgage Brokers spokeswoman Colleen Dennehy. "Borrowers with more than 20% equity are in a much stronger position to negotiate with the help of a broker," Dennehy said.

"One size has never fitted all, but that is even more true now," she said.

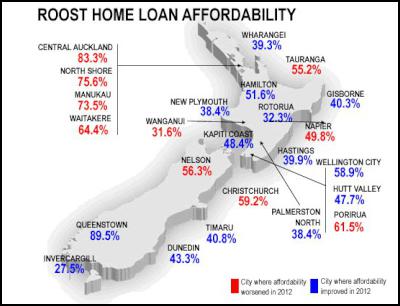

The Roost Home Loan Affordability reports show national affordability worsened to 57.5% in September from 56% in August after the national median house price rose to NZ$400,000 from NZ$390,000 in August. The reports show improvements in 8 regions and deteriorations in 16 regions, largely due to movements in house prices in those areas. The reports measure the percentage of after tax pay needed to service an 80% mortgage on a median priced house.

The Roost Home Loan Affordability report for September showed affordability for regular home buyers improved in Tauranga, New Plymouth, Napier, Nelson, Hutt Valley, Porirua and Palmerston North, but worsened across all parts of Auckland, Hamilton, Whangarei, Wanganui and everywhere in the South Island south of Nelson.

It was toughest for first home buyers in Auckland. It took 89.2% of a single median after tax income to afford a first quartile priced house in South Auckland in September, while it took 100.7% in the North Shore.

Affordability on the North Shore was at its worst level in more than 3 years.

Nationally, affordability for someone on a single median income worsened by 1.5% in September from August, which meant it took 57.5% of after tax income to afford an 80% mortgage on a median house, according to the Roost home loan affordability report released today.

Average fixed mortgage rates, which more than 50% of new borrowers now use, fell slightly in September for those with more than 20% equity and after-tax wages rose just over NZ$1 per week to NZ$809 per week. Interest rates rose for those borrowing more than 80% of the value of the home.

Housing affordability has become a major economic and political issue over the last year. The Reserve Bank and Government agreed on a toolkit of 'macro-prudential' controls in May that would see the central bank impose limits growth in high loan to value ratio mortgages. Central and local governments are also moving to address housing supply shortages.

For first home buyers – which in this Roost index are defined as a 25-29 year old who buys a first quartile home – there was also a deterioration in affordability in most cities.

It took 47.2% of a single first home buyer's income to afford a first quartile priced house nationally, up from from 47.1% a month earlier. The most affordable city in New Zealand for first home buyers was Wanganui, where it took 24.2% of a young person's disposable income to afford a first quartile home. The least affordable was the North Shore of Auckland at 100.7%.

Any level over 40% is considered unaffordable, whereas any level closer to 30% has coincided with increased buyer demand in the past.

For working households, the situation is similar, although bringing two incomes to the job of paying for a mortgage makes life considerably easier. A household with two incomes would typically have had to use 37.9% of their after tax pay in September to service the mortgage on a median priced house. This is up from 36.9% in August.

On this basis, most smaller New Zealand cities have a household affordability index below 40% for couples in the 30-34 age group. This household is assumed to have one 5 year old child.

For households in the 25-29 age group (which are assumed to have no children), affordability nationally worsened to 23.3% of after tax income in households with two incomes required to service the debt, up from 23.2% the previous month.

Any level over 30% is considered unaffordable in the longer term for such a household, while any level closer to 20% is seen as attractive and coinciding with strong demand.

First home buyer household affordability is measured by calculating the proportion of after tax pay needed by two young median income earners to service an 80% home loan on a first quartile priced house.

Question and Answers about the report

How does interest.co.nz work out these numbers?

Interest.co.nz gathers data from Statistics New Zealand and IRD on wages in each region, data from the Real Estate Institute from each region each month, and data from banks and non-banks on interest rates. It has calculated home loan affordability going back to the beginning of 2002.

How is this survey different from the Massey University survey of affordability?

The Massey study is only done quarterly rather than monthly and uses an index of Home affordability rather than actually measuring home loan affordability. It uses an index rather than the actual measure of the proportion of after tax pay needed to service an 80% mortgage on a median home. The exact composition and meaning of the index is not detailed.

Why use a single median income rather than household income?

It’s true that most homebuyers are using a combination of one or more full or part time incomes to service their mortgage. Each household is different and may be using incomes from different sources. The best measure of average national household income is calculated officially once in every three years by Statistics New Zealand. Interest.co.nz chose to use the median income data series from IRD and Statistics NZ because it can be measured monthly and can be drilled down by region and by age. We do include a chart showing how many median incomes are required to keep mortgage payments at 40% of take home pay. It is currently around 2 median incomes.

Why is home loan affordability important?

It is a useful way to work out if a housing market is overvalued. It’s clear house prices stopped rising when the national affordability ratio rose above 80% or 2 median incomes to service the average home loan. It’s a way of comparing affordability of housing markets with a national average and comparing housing values from one year to the next. For example, the affordability ratio in 2002 before the housing boom really took off was around 41%.

About Roost

Roost is the sponsor of this Report, and the Reports must be referred to as the Roost home loan affordability reports. Roost, owned by AMP, is one of New Zealand’s largest independent home loan and investment property mortgage brokers with 16 franchisees nationwide. Roost offers to source the perfect loan for its customers from a panel of lenders and insurance advice from Roost insurance specialists. Roost was established in 1996. For more information please visit www.roost.co.nz

Click for big version.

ENDS

Gordon Campbell: On The Left’s Electability Crisis, And The Abundance Ecotopia

Gordon Campbell: On The Left’s Electability Crisis, And The Abundance Ecotopia NZ Government: Stay Safe On Our Roads This Easter

NZ Government: Stay Safe On Our Roads This Easter YWCA: Global Push Back Against Gender Equality A Growing Crisis In Aotearoa

YWCA: Global Push Back Against Gender Equality A Growing Crisis In Aotearoa Te Pāti Māori: Ngarewa-Packer - Fast-Tracking Seabed Mining Ignores Māori Opposition And Environmental Precedent

Te Pāti Māori: Ngarewa-Packer - Fast-Tracking Seabed Mining Ignores Māori Opposition And Environmental Precedent New Zealand Defence Force: Defence And Customs Strengthen Maritime Security With Uncrewed Surface Vessels

New Zealand Defence Force: Defence And Customs Strengthen Maritime Security With Uncrewed Surface Vessels SPCA: Huge Win With New Dog Tethering Regulations

SPCA: Huge Win With New Dog Tethering Regulations Community Housing Aotearoa: Ngā Wharerau o Aotearoa Says New Partnership Model Helping Ensure Right To A Decent Home Is Realised

Community Housing Aotearoa: Ngā Wharerau o Aotearoa Says New Partnership Model Helping Ensure Right To A Decent Home Is Realised