QV average value for Auckland tops $1 million dollars

STRICLY EMBARGOED UNTIL 12 NOON SEPTEMBER 6, 2016

QV average value for Auckland tops $1 million dollars

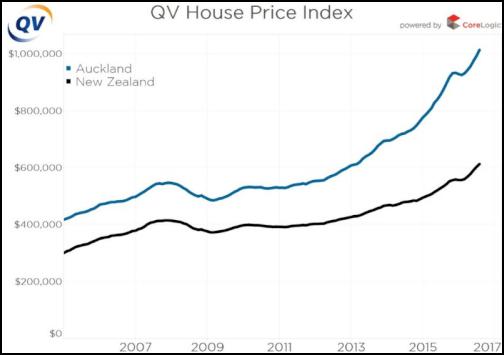

The latest monthly QV House Price Index shows that nationwide residential property values for August have increased 14.6% over the past year. Values rose by 6.0% over the past three months and are now 47.8% above the previous market peak of late 2007. When adjusted for inflation the nationwide annual increase drops slightly to 14.2% and values are now 25.6% above the 2007 peak. The average value nationwide is $612,527

The Auckland market has increased 15.9% year on year and 6.1% over the past three months. Values there are now 85.5% higher than the previous peak of 2007. When adjusted for inflation values rose 15.4% over the past year and are 57.5% above the 2007 peak. The average value for the Auckland Region has now ticked over the one million dollar mark and is $1,013,632.

The full set of QV House Price Index statistics for all New Zealand for August can be downloaded by clicking this link: QV House Price Index (HPI) for August 2016.

QV National Spokesperson Andrea Rush

said, “We can confirm that the QV House Price Index

average value for the Auckland Region has now topped one

million dollars following a strong quarter with values

rising 6.1% over the past three months.”

“There was a strong surge of activity in June and July however it now appears the new LVR restrictions for investors adopted by banks towards the end of July have started to have an impact in the housing markets in Auckland, Tauranga and Hamilton during August.”

“In recent weeks there has been a drop off in market valuation requests, auction clearance rates, open home attendees and loan application rates in these centres.”

“The Wellington market however continues to see strong growth with values there increasing at a faster rate than the Auckland region over the past year and the Dunedin market also continues to show strong levels of activity and demand.”

“Some regional centres have also seen significant value growth of more than 25.0% over the past year including Whangarei, Rotorua and Queenstown.”

“The Christchurch market by comparison is relatively flat with a shortage of listings in the market resulting in not much activity apart from in the new build and sub-division part of the market.

The latest CoreLogic buyer classification data for Q3 2016 shows multiple property owners continue to be very active across the Auckland region – accounting for 45.9% of sales. They are even more heavily concentrated in the North Shore and Auckland City, at over 50% of sales for Q3. Across the rest of New Zealand multiple property owners accounted for 42.3% of all sales.

Auckland

Home values across the Auckland region have risen strongly over the past quarter.Despite recent indication activity may be cooling, this is yet to impact on value growth.

The former Auckland City Council central suburbs have increased by 14.3% over the past year and a 5.3% over the past three months .The average value there is now $1,180,245. Values in the former North Shore City suburbs also rose 14.9% year on year and 5.5% over the past three months. The average value there is now $1,183,443. Manukau suburbs continued to see very strong value growth over the past year with values there rising 19.5% year on year and 6.9% over the past three months, the average value there is now $881,828. Waitakere City rose 14.7% year on year and 5.5% over the past three months. The average value in the West is now $806,832.

QV General Manager Jan O’Donoghue said, “Despite the average value across the region hitting a milestone of $1 million dollars following a surge of activity ahead of the new lending restrictions being announced in July, there’s been a noticeable easing in market activity across Auckland over the past couple of weeks.”

“More homes are passing in at auction, or receiving no bids although properties are still selling post auction by negotiation.”

“We saw a similar trend about this time last year when new LVR’s of a 30% deposit were announced for investors in the Auckland region.”

“So it’s most likely this change in the market is being caused by the latest LVR restrictions requiring a 40% deposit by investors as well as the continued lack of stock listed for sale in the market.”

“However, a shortage of listings and lower sales volumes do not seem to have impacted on value growth as yet they are still increasing.”

Hamilton

Home values across Hamilton City continue to show massive growth, up 29.3% year on year and 8.4% over the past three months. The average value in the city is now $518,387.

QV homevalue Hamilton Valuer, Stephen Hare said, “It appears demand for residential property throughout Hamilton has been easing back over the past month.”

“There are reports of a reduction in numbers of buyers attending open homes and auctions as well as a decrease in auction clearance rates with more properties passing in or having no bids at auctions.”

We are also seeing an increase in the marketing periods it is taking to complete a sale.”

“This is most likely as a result of the latest LVR restrictions requiring a 40.0% deposit for those purchasing investment property and it appears that the new measures are already resulting in reduced competition for properties in the market despite not formally coming into effect until October 1.”

“It’s likely that following this decrease in activity and demand we may start to see the rate of growth in home values across the city and region to start levelling out.”

Tauranga

Home values in Tauranga City are showing strong value growth over the past year rising 28.5% year on year and 7.0% over the past three months. The average value in the city is $633,638. Western Bay of Plenty home values also continue to show strong growth rising 26.3% year on year and 6.2% over the past three months. The average value in the district is now $557,640.

QV homevalue Tauranga Registered Valuer David Hume said, “There’ve been indications from brokers, lending institutions and real estate agents, that the new LVR restrictions requiring 40% equity for investors is starting to have an effect of cooling the Tauranga and Western Bay of Plenty markets.”

“Investors now need twice the equity they did five weeks ago and it appears they are taking a wait and see approach as they come to terms with the new restrictions and the speed of which they have been implemented.”

“There are still a number of first home buyers and pre-approved purchasers in the market driving demand.”

“It’s too early to tell what effect the new LVR restrictions will have on the market in the medium term and on values, but it’s unlikely the Bay of Plenty will see similar levels of growth in the coming year to that witnessed over the last 12 months.“

Wellington

The QV House Price Index for the entire Wellington region shows home values rose 17.2% in the year since August 2015 and 6.2% over the past three months and values are now 17.6% higher than in the previous peak of 2007. The average value across the wider region there is now $536,065.

Home values in Wellington City suburbs rose 5.6% over the past three months. The average value there is now $643,986. Lower Hutt rose 16.6% year on year and 7.1% over the past three months while Upper Hutt values were up 16.6% year on year and a huge 8.1% over the past three months; Porirua also rose 16.1% year on year and 6.5% over the past three months and the Kapiti Coast was up 15.0% year on year and 6.3% over the past three months.

QV homevalue General Manager, David Nagel said, “Despite the recently announced LVR restrictions for investors, residential property values in Wellington have continued to rise with strong demand from first home buyers and also well-established investors who have sufficient equity.”

“As a result of the new loan restrictions some less established investors have been taken out of the market and it’s quite likely we’ll see a slowdown in value growth in the short to medium term, particularly in locations which have historically been favoured by property investors.”

“In order to stay in the game, a number of investors are turning to second tier lenders and non-bank lenders to get around tough LVR restrictions.”

“New builds and off the plan purchasers have increased in popularity with a number of new residential developments in Wellington being sold well before completion. Given that new builds and off the plan purchasers are exempt from the new lending restrictions and require a lower deposit, the popularity of this segment of the market is likely to continue to increase.”

“Open homes and auctions are being well attended, particularly at the low to mid value range and first home buyers continue to look further afield from the Wellington City suburbs in an attempt to secure an affordable home.”

“In some instances it is not the highest offer which is accepted but the “cleanest offer” with the least amount of conditions. Proper due diligence is not always being carried out and this puts the purchaser at risk of unexpected expenses relating to their new purchase.”

“A severe shortage of listings has continued throughout August which could be due to fewer people listing their properties for sale during the cooler winter months and a number of home owners are choosing to stay put, using their equity to fund renovations rather than selling to upgrade.”

Christchurch

Home values in Christchurch City increased 3.5%

year on year and 0.5% over the past three months and they

are 29.9% higher than the previous peak of 2007. The average

value in the city is $492,766.

Values in the Waimakariri

District have risen 2.4% year on year and the average value

there is now $427,512; while values in the Selwyn District

are up 3.3% year on year and the average value there is now

$555,546.

“QV homevalue Christchurch, Registered Valuer Damian Kennedy said, “The new build and new subdivision market is seeing the greatest level of sales activity and interest in the Christchurch residential property market currently, with new homes being completed still selling well.”

“We saw asking prices reducing earlier in the year which have now stabilised. We have more new sections and homes coming on stream in substantive numbers.”

“There is a shortage of properties listed for sale in the market which is resulting in fewer sales and anecdotally, listings are around 30.0% lower than they were this time last year.”

“Agents are hoping it is just a more pronounced annual seasonal slow-down we see during the colder winter months - people’s gardens don’t look as good in the winter and we are the ‘Garden city’ so they tend to wait until spring before putting their property on the market.”

“It’s also possible people are choosing to stay put in their existing property, after a tumultuous few years following the major earthquakes.”

“Investors may also be waiting to see if the market picks up again now that the rate of growth has slowed from what it was in the first three years after the earthquakes.”

QV is also reminding Christchurch property owners that if their properties have unrepaired damage they are asked to complete an online survey so this can be taken into account in the Christchurch City Rating Revaluation being carried out this year. The survey is can be downloaded or completed online by clicking the link onwww.ratingvalues.co.nz

Dunedin

The Dunedin city home values have risen 11.5% year on year and 3.1% over the past three months. The average value in the city is now $333,890.

QV homevalue Dunedin Registered Valuer, Duncan Jack said, “We continue to see good sale prices being achieved across the Dunedin housing market with demand remaining strong and solid confidence in the market.”

“Multi-unit investment properties are selling well and much more quickly than in recent years when they tended to sit on the market for longer periods and often required price reductions to sell."

“They are now achieving good prices, with buyers putting in their best offer first in order to secure a sale in the competitive market we are experiencing currently.”

“Higher values properties in suburbs like Maori Hill and central Dunedin are also performing well, driven along by demand from owner-occupiers rather than investors.”

“Listings are on the light side which is often the case during the winter months and some agents are finding they don’t have enough listings to meet buyer demand.”

Hawkes Bay

Napier home values continued to rise up by 16.2% in the year since August 2015 and 5.7 % over the past three months. The average value in the city is now $386,615. While Hastings values also continue on an upward trend rising 15.2% year on year and 6.0% over the past three months. The average value there is now $359,679.

QV homevalue Hawkes Bay, Registered Valuer Bevan Pickett said, “The Hawkes Bay residential property market continues to remain very strong with good demand across all value ranges.”

“This high demand is still coupled with a shortage of good properties listed for sale which continues to create a supply shortage and this is still driving a lot of strength in the market.”

“Homes in the low-mid value range continue to be attracting the most demand, while new homes also continue to sell well with limited vacant land available.”

“The new lending restrictions have lowered the number of active out-of-town investors and taken a slight edge off overall market demand. Despite this, investors that are in a position to buy remain active in the market.”

Nelson

Nelson home values have increased by 13.9% year on year and 4.2% over the past three months. The average value in the city is now $473,624. The Tasman District also increased by 9.2% over the past year and 2.9% over the past three months and the average value in the district is now $463,596.

QV homevalue Nelson Registered Valuer Craig Russell said, “We are seeing a continuation of a strong winter market with record prices being achieved in some instances.”

“Satellite Townships such as Wakefield and Brightwater have experienced strong value growth in recent months.”

“Lifestyle properties which are well located close to amenities and with views have been highly sought after.”

“As demand is greater than supply sellers consider it prudent to hold onto their own property until they have secured their new purchase meaning that they do not get caught without having a home and it negates the fear of rising house prices between selling and buying.”

“Low interest rates, lack of supply and strong investor interest continues to drive the market. However, in saying this we are seeing a spike in first home buyers request valuations in recent weeks which is potentially a sign of investor 40% deposit restrictions taking effect.

“There is a lack available residential sections on the market, with new stages being snapped up soon after coming onto the market by buyers capitalising on the lower deposit required for new builds.”

Other Provincial centres

In the North Island, all areas measured saw values increase over the past year and many regional centres continue to show strong values rises with a number seeing higher percentage growth than Auckland including Whangarei values rising faster which rose 21.6% year on year; Rotorua up 27.1% over the same period; Otorohanga values rose 35.5% year on year and Kawerau is up by 50.1% since August last year. Palmerston North also saw values rise 10.4% year on year after a long period of little value growth.

In the South Island, most areas saw a value increase Queenstown Lakes Districts rose the most up 27.2% year on year; followed by Central Otago District 19.4% over the same period and the Mackenzie District was up 18.3% year on year; while Invercargill values were up 9.9% year on year.

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision

Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns

BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail

University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail