Auckland values continue to surge ahead

Auckland values continue to surge ahead

while other main centres plateau

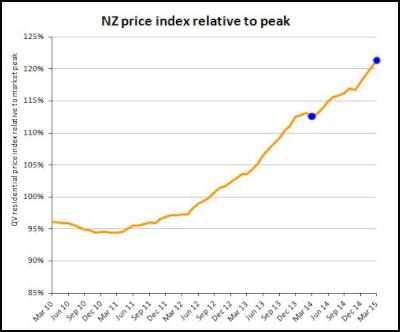

The latest monthly QV Residential Price Movement Index shows that nationwide residential property values for March have increased 7.7% over the past year and 2.8% over the past three months. This means they are now 21.3% above the previous market peak of late 2007. When adjusted for inflation the nationwide annual increase drops slightly to 6.8% and values are now 3.7% above the 2007 peak.

The Auckland market has increased 13.9% year on year, 4.6% over the past three months and 45.8% since 2007. When adjusted for inflation values are 13.0% over the past year and are 24.6% above the 2007 peak.

QV National Spokesperson Andrea Rush said, “The rate of growth in Auckland is exceptionally strong while values are rising more slowly than they were this time last year in Hamilton, Wellington, Christchurch and Dunedin.”

“Value increases are beginning to plateau in parts of the Christchurch market as the supply of new homes begins to meet the demand created by the earthquakes.”

“Values in Tauranga and Invercargill rose moderately, while the Hamilton, Wellington and Dunedin markets are quite flat.”

“The expectation is that Auckland will continue to accelerate while the rest of the main centres will remain steady with values either moderately increasing, staying flat or in some cases declining slightly.”

“The Government’s new Homestart policy may lead to increased activity amongst first home buyers around the country and it will remain to be seen whether this has an impact on values.”

“The Reserve Bank is considering tighter rules on borrowing to property investors which it has said may now be defined as those who own more than one property and thus could cover any property the owner does not live in.”

“Currently close to 40% of all residential house sales in New Zealand are purchased by those who own two or more properties and the Reserve Bank’s changes could come into effect as early as July 1 this year.”

Auckland

Home values have continued to show rapid growth across the Super City in the first quarter of 2015.

Auckland City values were led by Auckland City-South which saw a whopping increase of 5.4% over the past three months and 17.9% year on year which is the highest year on year increase in Auckland between March 2014 and March 2015. Auckland City-East values also accelerated 5.1% since January and 15.4% year on year. Auckland City-Central values were also up 4.7% over the past three months 11.3% year on year.

Waitakere City values also rose an exceptional 5.2% over the past three months, and values there were also up 14.1% year on year and are now 47.7% higher than during the peak of 2007.

In Manukau, Manukau-East values rose the most over the past three months, accelerating by 5.5%, and they increased 13.5% year on year; Manukau-North West values also increased by 4.9% over the past three months and 16.2% year on year; while Manukau-Central values rose 4.2% since January and 11.5% year on year.

On the North Shore, values in North Shore-Coastal accelerated 5.5% over the past three months and 13.2% year on year; North Shore–North Harbour values increased 4.3 % since January and 12.5% year on year; while North Shore-Onewa values rose 3.7% over the pat three months and 14.1% year on year.

Rodney District values also increased, up 3.0% over the past three months and 8.1% year on year; while Papakura values rose 3.8% over the past three months and 12.8% year on year.

QV homevalue Auckland

Valuer James Wilson said, “A large number of properties

have been coming onto the market during March. Those

properties that are well presented are not taking long to

sell.”

“Buyers are still wary of being priced out by

further increases. As a result they are willing to pay

premiums to secure properties.”

“Investors are still very active, capitalising on low interest rates and high equity across their portfolios.”

“There is strong demand for home and income properties which provide multiple units of income, increasing returns for investors or aiding owner occupiers with mortgage repayments.”

“The construction of minor household units is also becoming increasingly popular as people look to capitalise on strong demand for rental properties.”

“Demand for new builds is also still very high, fuelled by LVR exemption for new construction.”

“The apartment market continues to show signs of strengthening. Confidence in this sector is evident through the large number of new apartment complexes being constructed across the city and the fact that buyers are willing to purchase off plans to secure apartments within quality complexes.”

“QV homevalue Auckland valuers have also been completing valuations for renovation purposes, for people capitalising on the low interest rates.”

Hamilton and Tauranga

Residential property values in Hamilton City rose by 0.5% over the past three months, 3.4% year on year and they are now 3.4% higher than the previous peak of 2007.

Home values in Hamilton-South East increased the most, up 1.1% since January; Hamilton Central and North West were up slightly by 0.7%; Hamilton-North East values rose 0.6% and Hamilton-South West decreased slightly, down 0.5% over the same period.

Values continued to rise in the Waipa District, up 1.5% over the past three months, 5.8% year on year and they are now 7.3% higher than the previous peak of 2007. While values in the South Waikato continued a downward trend, decreasing 4.3% over the past three months and 4.8% year on year and they are now 23.5% lower than they were in the previous peak of 2007.

QV homevalue Hamilton Registered Valuer, Nicky Harris said, “Statistics show the median sales price of homes has dropped back slightly which is most likely due to first home buyers and investors being more active at the more affordable lower end of the market.”

“This doesn’t mean that sales prices are dropping but rather that the volume of sales at the lower end of the market has increased and this is bringing the median sales price down.”

“A lack of listings continues to lead to an increase in competition in the Hamilton market and properties that are going to auction are selling well and reaching good prices due to high demand.”

“Aucklanders are still coming down to Hamilton to purchase properties, either to move here permanently or to invest in the relatively more affordable homes here. Investors are still very active in the Hamilton property market.”

Home values in Tauranga City have risen by 1.7% over the past three months; 5.1% year on year and they are now 3.1% below the previous peak of 2007.

Values in the Western Bay of Plenty decreased slightly by 1.0% over the past three months, however they increased 2.4% year on year, and they remain 6.9% below the previous peak of 2007.

QV homevalue Registered Valuer Jessica Videbeck said, “The Tauranga market appears strong with increasing demand and a lack of supply.”

“There is a lot of interest in Mount Maunganui homes in the $600,000 to 900,000 price bracket and we are seeing more activity at the top end of the market.”

“There are a low number of properties listed for sale in Papamoa and Mt Maunganui and those homes that are for sale, are selling quickly.”

“We are still seeing a lot of people moving down from Auckland and buying property in the Bay of Plenty as they look for more affordable homes out of the Super City market.”

“There is also a severe shortage of rental properties available due to high demand outstripping supply and this has led to a dramatic increase in rents across the city.”

Wellington

Home values in the Wellington region overall are quite flat increasing just 0.8% over the past three months, 0.5% year on year and they are now 0.3% higher than the previous peak of 2007.

Wellington–North values increased the most over the past three months, up 1.8%; followed by Lower Hutt, up 1.4%. Wellington- Central and South values remained flat up just 0.1%; Wellington–East saw values decrease slightly by 0.2%; Wellington–West values increased slightly by 0.2%; while Upper Hutt values increased slightly up 0.7% over the same period.

QV homevalue Wellington Registered Valuer Kerry Buckeridge said, “In Wellington City there has been a reasonable level of activity and things are definitely more positive than mid 2014.”

“Well presented and located properties are selling well and values have lifted a little.”

“In the Hutt Valley the surplus stock that was available in February has sold well over the summer period and has not so far been replaced with few new listings coming onto the market. Sales activity and values there remain steady.”

“The residential property market in Porirua is very flat with not a lot of value movement however, the market there is also ticking over and steady.”

Christchurch and Dunedin

Home values in Christchurch City increased 0.5% over the past three months, 5.3% year on year and are now 24.4% higher than in the previous peak of 2007.

A closer looks across the city shows Christchurch Hills and the Selywn District both saw values increase 1.6% over since January; Christchurch East values were up slightly by 0.5%, and Christchurch–Central and North rose just 0.1% over the same period. Values in Waimakariri District values were steady, rising just 0.2% over the past three months and Banks Peninsula values decreased by 1.9% since January.

QV Christchurch Registered Valuer Daryl Taggart said, “The market is reasonably busy and there is steady interest, particularly in well presented and maintained properties, while those that need work or are a bit tired, are taking longer to sell.”

“In the Waimakariri District surrounding Christchurch we are starting to see value increases flatten off particularly in areas which saw some significant increases in values two to three years ago when land there opened up for new subdivisions.”

“Since then, a lot of new homes have been built or are now under construction. Indications are that activity is now starting to slow down which is leading to a slowing down in value levels to below that of Christchurch City.”

“The Selwyn District is currently continuing to match value growth in the city suburbs however indications are that value increases there may also be slowing.”

“This cooling in demand for property in outer Christchurch is most likely due to there being a greater supply of homes in other parts of the city. This is due to repair programmes on damaged homes being completed and the building of new homes around the city, meaning demand is aligning with supply.”

Home values in Dunedin City as a whole are increased slightly by 0.6% year on year, and values there are now 1.8% higher than they were the previous peak of 2007.

Taking a closer look, Dunedin-Central and North values rose by 0.8% over the past three months while other places across the city saw slight declines in value over the same period; Dunedin-Taieri values decreased by 0.3%; Dunedin-South were also down by 1.2% and Dunedin-Peninsula and Coastal values have also decreased by 1.4% since January.

QV homevalue Dunedin Registered Valuer Duncan Jack said, “The Dunedin market is experiencing good activity levels with both listings and enquiries and there is reasonably good demand for most residential properties across all the value ranges.”

“Most properties are selling reasonably quickly due to the demand and multiple offer scenarios are increasingly common.”

“Despite demand, we are not seeing anything more than moderate increases in value with data indicating value levels to have been fairly flat during the past few months and only slight positive growth during the past year in most suburbs.”

Provincial centres

Residential property values in many of the provincial centres were either flat or down slightly with some others showing moderate increases.

In the North Island, a downward trend in property values was seen in the Rotorua District where values decreased by 3.0% over the past six months, Gisborne District values were also down by 1.6% since January, and values in the Wanganui District have decreased by 1.0% over the same period.

In the South Island, Queenstown Lakes District values continued on the upward trend seen for some months rising 3.3% over the past three months and 7.2% year on year, the average value there is now $715,787 which is the highest average value of any area outside Auckland.

Values in the Buller District continued a downward trend, decreasing 1.9% over the past three months and 5.6% year on year. While values in Invercargill have increased by 1.9% since January and they were up by 0.8% compared to this time last year.

Click here to see the QV Residential Price Movement Index for March 2015.

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can

Vegetables New Zealand: Asparagus Season In Full Flight: Get It While You Still Can  Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone

Bill Bennett: Download Weekly - How would NZ telecoms cope with another cyclone NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding

NZ On Air: Firm Audience Favourites Lead NZ On Air Non-Fiction Funding Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision

Insurance and Financial Services Ombudsman: Woman Gets $40k More After Disputing Insurer’s Decision BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns

BNZ: A Quarter Of Older NZers Fear Going Online Due To Scam Concerns University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail

University of Auckland: Scientists Develop Tool To Monitor Coastal Erosion In Fine Detail